2018 Annual Results

Angers, March 25, 2019

Annual revenue: €82m up 2.5% (5.9% at constant exchange rates)

Current operating margin in line with expectations: 12.9%

Double-digit growth in business in second-half 2018

Revenue for the financial year ended at €82m, up 2.5% (+5.9% at constant exchange rates), with a contrasted performance between first and second-half 2018. After a first-half marked by unfavorable currency effects and project postponements, second-half 2018 posted double-digit growth of 11.7%, reflecting an upturn in business.

Channel business, which accounted for 66% of revenue in 2018, stood at €55.8m. Growth came out at +3.7% (+6.8% at constant exchange rates), notably demonstrating the roll-out of the Edikio solution in Europe and sales growth in North America and India, where structuring started last year is gradually generating results.

Projects business grew +1.6% (+6.3 % at constant exchange rates). Second-half 2018, driven by the roll-out of two major projects in Germany and India, delivered an excellent performance, with year-on-year growth of 26%.

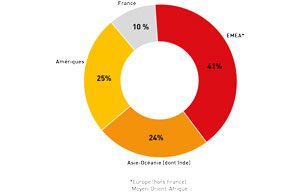

In terms of regions, all saw growth at end-2018. The EMEA region (€42.3m) saw business up 1.8% (+2.5% at constant exchange rates), impacted by the geopolitical situation in the Middle-East. The Americas region (€20.1m) grew +4.4% (+10.1% at constant exchange rates), reflecting the ramp-up in the new sales team, particularly in the Channels business. Finally, the Asia-Pacific region posted revenue of €19.6m, up 2.1% (+9.1% at constant exchange rates), driven in particular by the Projects business across the region and the Channels business in India.

2018 annual results: current operating margin in line with expectations

Gross margin at end-2018 stood at €49.1m, stable year-on-year (€49.4m), against a background in which the Projects business impacted the average selling price in the second half of the financial year. The gross margin rate came out at 59.9%, versus 61.8% last year.

Operating profit was maintained. It amounted to €11.6m, an operating margin of 14.1%, reflecting Evolis’ vigilance as regards its cost structuring.

After recognizing a one-off payment expense in shares of €1m, which did not impact cashflow and related to the 2017 free share allocation plan, the current operating margin ended at 12.9%, in line with the press release issued in September 2018.

Operating profit factors in €1.8m of one-off items, owing to litigation and two client bankruptcies. These items had a one-off impact on operating margin, which stood at 10.7%. Evolis has implemented the measures needed to resolve the litigation without however being able to predict a favorable resolution.

With a currency gain and lowered tax expenses versus 2017, profit stood at €6.1m, a net margin of 7.4%.

Higher cash position

Group net cash was at €23.2m at December 31, 2018, up on 2017 (€19.1m). This trend reflects the Group’s strict financial management, with cashflow of €10.5m, an improved WCR (+€2.1m) and moderate investment at €3.8m, o/w €1m one-off related to works to expand the Group’s headquarters, needed to support continued growth.

Proposed dividend of €0.85 per share

Given the maintained cashflow in 2018 and strong financials, the Group has decided to propose a dividend of €0.85 per share to the General Shareholders’ Meeting to be held on May 16, 2018.

2019 revenue growth outlook: +7% at constant exchange rates

In 2019, new products will bolster Evolis’ range. Edikio Guest, the labeling solution for the hotel and catering industry launched in December 2018, should gain momentum in 2019. Evolis will also launch premium value-added solutions that will fuel both the distribution network of its Channels business and the Projects business offer, to capture growth in the banking and government markets.